The internet's top superpower is its ability to provide information to everyone. Rendiva GPT utilizes this feature. The journey to understanding the investment space may be backbreaking without necessary guidance. This pain point is exactly why Rendiva GPT emerged. We are that guide that points the way to investment education.

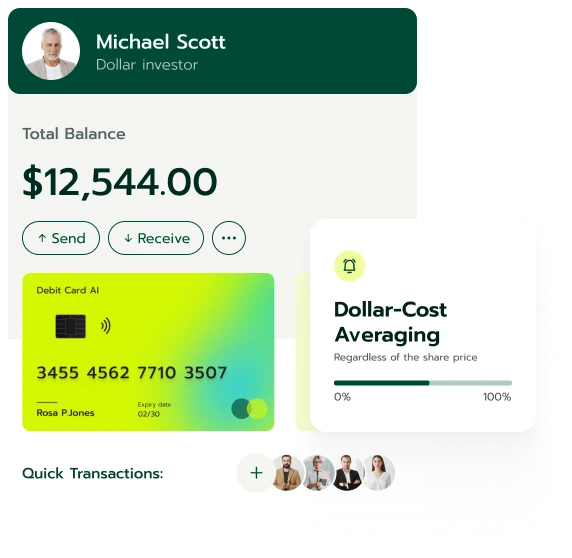

Rendiva GPT is for everyone. Every feature is designed to make starting an investment education easy. We connect users to suitable financial education firms.

Rendiva GPT is the bridge. We serve as a middleman between investment education firms and the average person. All that is needed is a quick registration on the website. It is that simple, and the best part is that it is completely free.

A standout feature of Rendiva GPT is how easy it is to register. The website prides itself on solving the difficulty of finding a suitable tutor. Everything about Rendiva GPT is designed with ease and convenience in mind.

In line with our commitment to bringing financial education to all, we don’t charge a dime. Sign up, and we’ll assign a financial education firm in minutes. All for free!

The firms we assign have suitable resources and tutors. They also employ a personalized approach when training people.

Rendiva GPTis a global solution. Language is not a barrier. Anyone anywhere can begin on the path to financial literacy.

The website promotes inclusivity. We take away the hindrances to financial enlightenment for all.

Registering on Rendiva GPT is quite simple. Prospective users just need to provide their names and other important information. Rendiva GPT then begins its work. We connect users to investment education firms tailored to their goals.

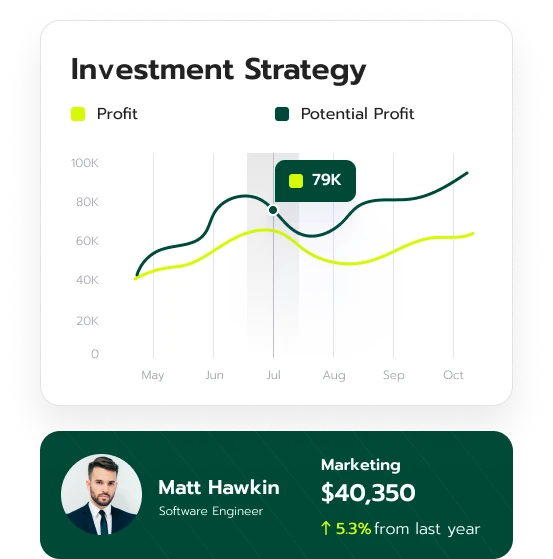

This step is solely dependent on Rendiva GPT. Here, we connect newly registered users to investment education firms.

Rendiva GPT facilitates this one-on-one conversation. Someone from the assigned education firm reaches out to provide more info about the learning journey ahead. They’ll also note the user’s areas of interest and craft a suitable curriculum accordingly.

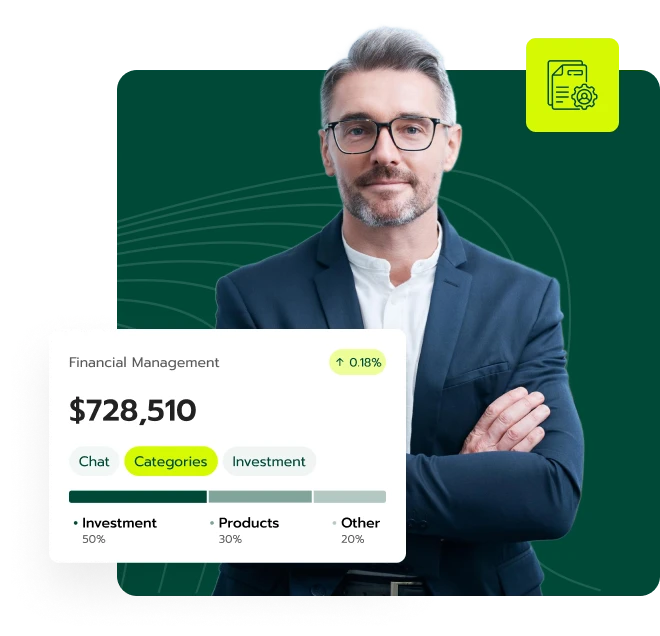

The financial and investment market can be a slippery slope. It is very important that interested people acquire adequate knowledge first. Rendiva GPT is a bridge linking users to investment education firms. These firms have materials that teach the fundamentals and terminologies related to investments.

People interested in investments have to carefully study the complexities of the financial market. They should acquire the necessary skills to hold their own in the investment space. Investors have to make informed decisions. This is the goal of Rendiva GPT. We want people to learn enough about the practice to be able to do so.

Short selling is a common strategy used by traders. They use it when they believe that the market is at an all-time low. People who make use of this strategy sell their assets at a high price.

Then, if the market corrects, they buy them back at a low price. This strategy carries a lot of risks. In some cases, it may be illegal. Possible advantages of short trading include:

Traders engage in short selling to try for gains. This is especially true in a bear market. They bet on the decline of assets in the market, and they may make returns from this decline.

Short selling simply involves betting against an asset. It may help investors protect their portfolios and reduce risks or losses.

Increased Liquidity

When a trader sells an asset, they convert it into cash. The ease with which this can be done indicates liquidity. This is very important, especially when the market is unstable.

Flexibility

When a trader short sells, they are able to trade on either market. Whether bullish or bearish, they may pursue gains in a broader sense from both trends.

Short-term Focus

Investors may gain from short selling than from other methods at a quicker rate.

Gains from short selling may then be invested in other assets. It can help investors diversify their portfolios.

Short selling allows traders to short a stock while just putting up a portion of the stock’s entire value. This might help them to increase their returns on a given investment.

Annuities are a commonly used term in the investment world. They are investments that may provide streams of income over a specific period.

An investor may pay a certain amount of money either in batches or at once to an investment firm. This firm could then offer regular income payments to the investor.

Annuities are mainly intended for retirement purposes. They may provide an option for lifetime payments for investors in their later years. People curious about annuities should sign up on Rendiva GPT to learn more.

Passive investment is simply a long-term approach to investment. Here, investors buy a mix of assets and securities. They then hold onto them regardless of market conditions.

It can be likened to owning a garden where a variety of herbs are planted. They are left to grow on their own without doing too much to them. Interested in learning more about passive investment? Sign up on Rendiva GPT. Key features of passive investment include:

Passive investing is a very simple and uncomplicated approach to investing. It requires less time and even effort to manage. This makes it suitable for beginners.

Passive investments may help reduce risk. Its focus is on a mix of assets and securities. This diversity tries to eliminate a single point of failure.

With active investing, there’s a middleman. With passive investing, the middleman is cut out, which may help investors save money. Since less effort is required for passive investment, any service needed will also cost less.

With passive investments, investors buy a mix of different assets and securities. This ensures that their portfolio is broad and that risk is spread out.

Hedge funds are commonly used by certain kinds of investors. Such investors typically have a lot of funds at their disposal. They seek to gather their resources to pursue high-risk investments. Hedge fund investors invest in a range of assets, including real estate, cryptocurrencies, derivatives, etc.

Understanding hedge funds may help people familiarize themselves with the strategies that might maximize gains and minimize risks. To learn more about hedge funds, register on Rendiva GPT for free.

There are various methods of carrying out analyses of investments. Fundamental analysis is one. It’s used to assess the strength of an asset. This is done over a certain period and even into the future.

Fundamental analysis focuses on studying financial and non-financial data related to an asset. It involves accessing the economic condition and industry trends of the market at that point in time. It helps investors make educated decisions.

Investors apply it to determine whether an asset is overpriced or underpriced. This is usually based on the asset's features. It provides a long-term view. This makes this method suitable for people who practice passive investing.

Assets class is a group of investments that have similar qualities. They are also subjected to the same regulations and risks. These investments can be either physical or financial.

This includes tangible goods like gold, silver, textiles, and even agricultural products. Derivatives based on these products are traded in the financial market.

Real estate includes landed property like houses, apartments, commercial buildings, shops, and stores. Owners may seek gain from selling or renting their properties.

This is also known as stocks. It represents ownership of shares in a particular company. When a person owns a stock, they may receive regular payments or dividends.

A major example of this is a bond. Bonds are loans people make to the government or a company. In return, they may be paid interest regularly.

This refers to money in savings accounts, certificates of deposits, or treasury bills. This kind of asset class is low-risk. It can also be easily accessible.

Special items such as art, rare coins, postage stamps, classic cars, antique furniture, artwork, etc., are also types of asset classes.

Rendiva GPT makes access to investment learning easy. We advocate for an education-first approach in the investment world. Our goal is to create a world of savvy investors. We do this by connecting people interested in investments with firms that can teach. With Rendiva GPT, anyone can learn investment techniques and concepts.

| 🤖 Registration Fee | Zero cost to register |

| 💰 Administrative Fees | Fee-free service |

| 📋 Enrollment Ease | Simple, quick setup |

| 📊 Study Focus | Insights into Digital Currencies, Forex, and Investment Funds |

| 🌎 Country Availability | Available in nearly every country except the US |